Atome Financial achieves record profit and revenue growth in 2024

Atome Financial posts record US$236M profit in 2024, with revenue growth accelerating past US$500M in Q2 2025.

Atome Financial has reported its strongest financial results to date, with audited figures showing an operating income of US$236 million for the year ending 31 December 2024. This marks a 63 per cent increase year-on-year and confirms the company’s first full-year profit. The milestone reflects Atome’s ability to combine disciplined execution and operational efficiency while navigating a challenging macroeconomic environment.

Table Of Content

The company, which operates Atome’s Buy-Now-Pay-Later (BNPL) service, Atome Card, and Kredit Pintar, processed over US$2 billion in Gross Merchandise Volume (GMV) in 2024, representing a 50 per cent year-on-year increase. The growth was supported by strong merchant partnerships and increasing consumer adoption across Southeast Asia.

Continued acceleration into 2025

Momentum carried into the first half of 2025, with Atome recording further gains in the April to June quarter. By the end of Q2, annualised net revenue surpassed US$500 million, driven by GMV that had crossed the US$4 billion mark.

Product diversification has been one of the main contributors to this growth. Atome has expanded beyond BNPL into insurance, savings, cards, and lending. In the Philippines, the Atome PayLater Anywhere Card saw rapid adoption, with the number of cards issued exceeding 1.5 million as of June 2025.

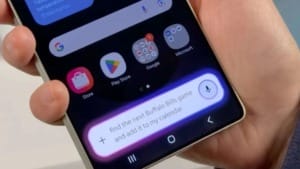

Operational efficiency has also played a central role, with the company deploying Generative AI to improve customer service, collections, and credit underwriting. This has enabled Atome to scale its operations more effectively while maintaining its focus on core business functions.

Backed by strong financial partners

The company’s expansion has been supported by a robust funding base from global and regional institutional partners. These include BlackRock, EvolutionX, Innoven Capital, and CLSA’s Lending Ark. Additionally, Atome expanded its syndicated credit facility led by HSBC, with participation from DBS, SMBC, and Baiduri Bank.

Jefferson Chen, CEO of Atome Financial, said, “Atome Financial’s record performance in 2024 and 1H2025 reaffirms the strength of our ‘wallet’ platform and our ability to grow sustainably while delivering real value to consumers and partners. Since Day One, our mission has been to improve lives through greater financial access and technology. With a profitable BNPL business, a growing Atome Card franchise and broadening funding partnerships, we are well-positioned to shape the next phase of financial inclusion in Southeast Asia.”

Outlook for Southeast Asia

Atome’s results come at a time when digital financial services are gaining momentum across the region, with increasing demand for accessible and flexible payment solutions. The company’s success highlights the growing relevance of integrated financial platforms that combine lending, payments, and personal finance products into one ecosystem.

With a focus on sustainable growth, Atome appears set to strengthen its role in driving financial inclusion in Southeast Asia. Its profitable BNPL segment, expanding card business, and partnerships with leading financial institutions underline its capacity to build on recent achievements and pursue new opportunities in the coming years.