Intel lands major client Amazon for custom AI chips, boosting foundry business

Intel secures Amazon Web Services as a major client for custom AI chips, boosting its foundry business and marking a big step in its revival strategy.

Intel has scored a significant win in contract manufacturing, or foundry business, by securing Amazon’s cloud services unit as a new customer. This major partnership, announced on Monday, will see Intel designing and manufacturing custom artificial intelligence (AI) chips for Amazon Web Services (AWS), marking a strong vote of confidence for the chip maker.

Table Of Content

This deal signals a substantial boost for Intel, which has been working hard to revitalise its position in the highly competitive semiconductor industry. Intel’s shares surged by around 8% following the announcement, reflecting the market’s optimism. The memo shared by Intel’s CEO, Pat Gelsinger, outlined the company’s plans to collaborate with AWS and highlighted further cost-cutting measures to strengthen its overall performance.

Custom AI chips for AWS

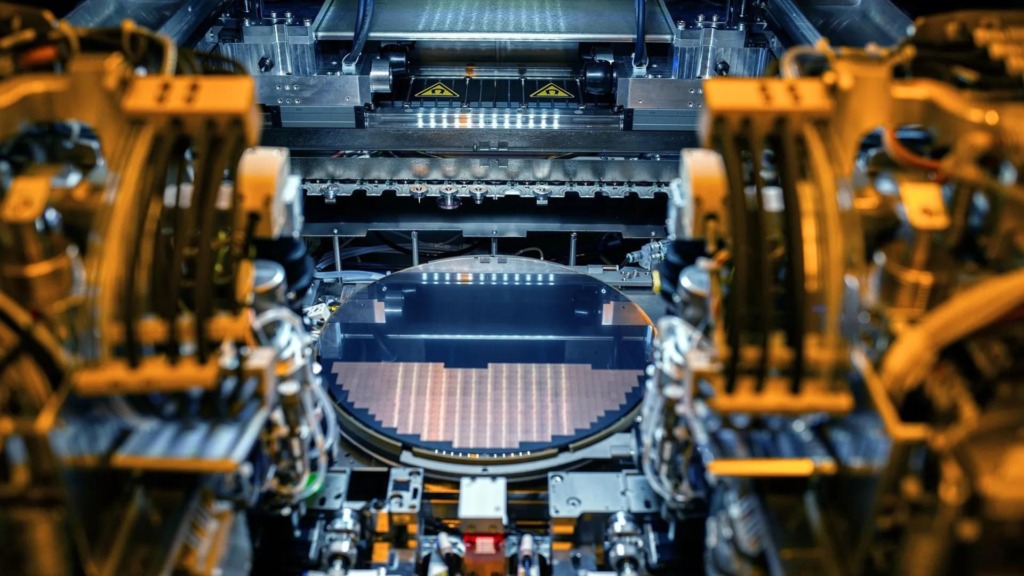

AWS has been designing its chips for data centres, but this new partnership with Intel takes things further. Intel will be tasked with producing a specialised “artificial intelligence fabric chip” using its 18A process, its most advanced chip manufacturing technology available to external customers. This collaboration indicates a close relationship between the two tech giants, as Intel aims to support AWS with its cutting-edge chip designs.

Intel also hinted that more chip designs from AWS could be coming, including versions using the upcoming 18AP and 14A processes. These manufacturing techniques are expected to play a key role in driving future innovations as both companies work towards advancing AI technology in the cloud computing space.

Gelsinger’s revival strategy

Pat Gelsinger, who became Intel’s CEO in 2021, has been vocal about his plans to revive the company’s fortunes. In his memo, Gelsinger acknowledged that Intel has faced significant challenges, including a disappointing second-quarter earnings report last month. However, he stressed that the deal with Amazon indicates that Intel is on the right track.

The memo also detailed Intel’s broader recovery strategy. To improve efficiency and profitability, Intel is planning several steps, including selling a stake in its programmable chip business, Altera. In addition, the company is pausing its chip factory project in Germany for two years, a decision that Reuters had already reported. A similar delay is planned for its operations in Poland, though Intel remains committed to its manufacturing expansion in the United States.

Foundry business to become more independent

As part of Gelsinger’s vision, Intel’s foundry business will become more independent, a move designed to give it greater freedom and flexibility. This includes attracting outside investments, and Intel plans to establish the foundry as an independent subsidiary with its board of directors overseeing operations. Earlier this year, Intel began separating the financial performance of its foundry business from its design business to create clearer divisions.

This newfound independence is expected to allow the foundry to grow and become more competitive as Intel looks to attract more high-profile clients like AWS. Only now has Intel struggled to announce significant customers for its foundry operations publicly, but the deal with Amazon has changed that dynamic.

Additionally, Intel plans to reorganise several other divisions, including those focused on automotive and “edge” computing, to ensure the company stays at the forefront of technological advancements. This reorganisation is part of a wider effort to refocus the company’s efforts on its core technologies, particularly central processing units (CPUs), which have long been Intel’s main strength.

In a separate announcement on Monday, Intel revealed that it has been awarded up to US$3 billion in direct funding from the US Chips and Science Act. This funding is part of the Secure Enclave programme, which aims to enhance the security of chip manufacturing within the United States.

Despite the positive news, Intel is also preparing for some difficult decisions. The company has confirmed it will send layoff notices to around 15,000 employees in October, following its announcement of planned job cuts in August. This measure is part of its ongoing efforts to streamline operations and cut costs in a challenging market environment.