Bloomberg hosts first Code Crunch Hackathon in Singapore to advance real-world financial innovation

Bloomberg hosts its first Code Crunch Hackathon in Singapore, showcasing student and industry solutions for real-world financial challenges.

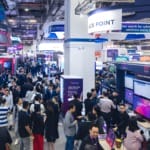

Bloomberg has completed its first Code Crunch Hackathon in Singapore, bringing together student teams from Nanyang Technological University and professionals from several financial institutions to present data-driven solutions for real-world financial challenges.

Table Of Content

The finale took place on 29 October 2025 and marked the close of a three-month programme built around Bloomberg’s BQuant Desktop and BQuant Enterprise platforms.

Student teams explore market behaviour

Bloomberg designed the initiative to strengthen collaboration between aspiring and established quantitative specialists while encouraging the development of advanced tools for investment research. Participants received access to Bloomberg’s analytics platforms and attended a training session led by Bloomberg specialists, which helped them build skills needed for market modelling and strategy design. Each team was tasked with solving a financial challenge or designing a new investment approach.

Kelvin Cen, Head of Southeast Asia at Bloomberg, said the event demonstrated the depth of quant and AI expertise emerging in Singapore. He noted that the finance sector continues to look for ways to use AI and machine learning to support better investment decision-making, and the programme was intended to inspire innovation that could uncover new signals and improve performance.

Three NTU student teams reached the finale after developing indicators designed to interpret market behaviour during both stable and volatile periods. Their work centred on strategies to forecast trends, model sentiment shifts and identify abnormal market conditions.

Team CodeQuants emerged as the winner for its Cross-Asset Divergence Indicator, an approach that aims to detect early signs of systemic stress and highlight how investor sentiment may influence market volatility. The team’s work also explored how signals across different asset classes may diverge during periods of uncertainty. As part of their award, the students will receive mentorship from Bloomberg’s Quant Finance team within the Office of the CTO, offering them exposure to advanced analytics and quantitative research practices.

Professor Byoung-Hyoun Hwang from the Nanyang Business School said training future coders and exposing them to industry practices has become increasingly important. He emphasised that programmes such as Code Crunch help prepare students for the job market while connecting them with Singapore’s growing quant and finance community.

Financial institutions apply AI-driven tools

Teams representing the Monetary Authority of Singapore, Singlife, Modular, Robeco, AIA and LGT Investment Management were asked to address real-world issues faced by the financial sector. Their work showcased dashboards, machine learning models and analytical frameworks designed to support alpha generation, risk mitigation and portfolio testing.

MAS received the Judges’ Pick for building PULSE, an AI-powered textual analysis dashboard that tracks sentiment from Bloomberg News to monitor changes in macroeconomic conditions. Robeco was recognised with the BQuant Mastermind award for its credit cross-currency relative value tool, which compared bond spreads across currencies to identify potential alpha opportunities.

Two teams received the Most Popular award following audience voting. MAS was recognised again for its PULSE tool, while AIA was selected for creating a visualisation and scoring system that assessed funds across thematic and traditional dimensions.

Three organisations received the Quantributor Award for innovation: Singlife, Modular and LGT Investment Management. Singlife developed a credit risk dashboard that merged AI signals, Bloomberg News data and internal information to support real-time monitoring. Modular built a dashboard for analysing FX swap spreads using seasonality, technical indicators and market data. LGT Investment Management created a multi-asset backtesting and quantitative analysis platform to explore new investment ideas.

Judging duties were carried out by Arun Verma from Bloomberg’s CTO Office, Adeem Altaf, Global Head of Market Specialists at Bloomberg, and Professor Hwang from NTU.

Bloomberg highlights BQuant’s role in quantitative research

Bloomberg stated that the Code Crunch Hackathon reflects its vision for BQuant Desktop and BQuant Enterprise as platforms that support scalable and collaborative quantitative work. The company highlighted its intention to help financial institutions meet growing demands for data-driven research, automation and modelling.

BQuant Desktop is included with the Bloomberg Anywhere subscription and provides access to Bloomberg data within a secure development environment, while BQuant Enterprise offers cloud-based infrastructure designed to scale investment workflows and accelerate research.