Tiger Brokers: Bringing institutional-grade AI intelligence to global retail investors

AI is redefining retail investing as platforms like Tiger Brokers’ TigerAI integrate verified intelligence, personalisation, and long-term wealth management to empower global investors.

Retail investing has entered a new era. Across Asia, individual investors are trading in record numbers through mobile-first platforms and increasingly intuitive interfaces. Yet, despite this surge in participation, retail traders still operate at a disadvantage. Institutional investors continue to benefit from integrated research systems, advanced analytics, and AI-driven decision support, while most retail platforms remain reactive, relying on static data and slow insights.

Table Of Content

As generative AI matures, the technology is transitioning from hype to meaningful application. Brokerages are embedding intelligence directly into trading platforms, empowering investors with faster data interpretation and context-aware recommendations. Regulators, including Singapore’s Monetary Authority of Singapore (MAS) and Europe’s ESMA, are now closely monitoring these systems, examining their implications for market transparency, data privacy, and consumer protection.

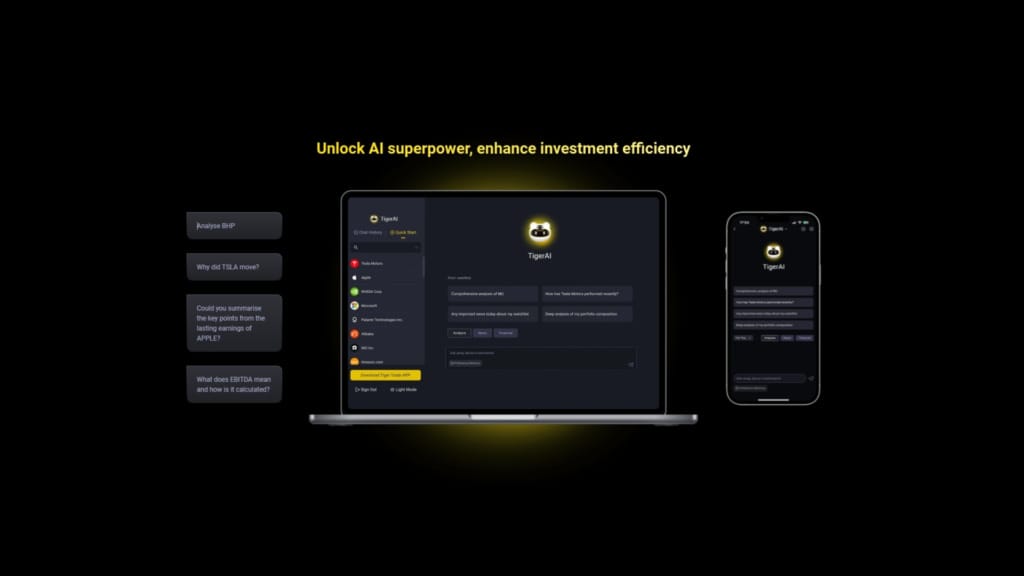

For Tiger Brokers, this moment represents an inflexion point. Its proprietary AI feature, TigerAI, introduces multi-model intelligence to its retail trading platform, Tiger Trade, offering real-time reasoning, verifiable insights, and privacy-centric design. The initiative seeks to bridge the long-standing gap between institutional precision and retail accessibility.

From single-model chatbots to multi-agent decision engines

Early generations of financial chatbots promised accessibility but delivered limited sophistication. Single-model systems often struggled to accurately interpret market context, leading to inconsistent or even misleading advice. The financial impact of these inaccuracies underscored the risks of deploying AI without deep domain understanding.

TigerAI takes a distinctly different path. Built on a multi-agent architecture, it integrates OpenAI’s GPT and DeepSeek’s R1 models with Tiger Brokers’ proprietary financial ecosystem. According to Jingxin Du, Product Lead for TigerAI, the platform uses a central controller to assign specialised agents to each query depending on its complexity. “For complex questions, a collaborative workflow is also established. One agent is dedicated to analysing user-defined watchlists, capable of performing iterative analysis on all selected stocks, while another agent specialises in addressing options-related queries.”

Each agent is fine-tuned for its role, optimised at the data, engineering, and prompt levels to ensure contextual precision. This design enables TigerAI to deconstruct multifaceted investment problems through sequential reasoning, combining market data, technical trends, and sentiment indicators into cohesive analysis. “By displaying the reasoning path behind its conclusions, the system reinforces transparency and trust. These are key foundations of safe, ethical, and reliable AI usage,” Du said.

This approach represents a broader shift in fintech AI. The industry is moving away from novelty-driven experimentation toward architectures built on accuracy, explainability, and resilience — qualities essential for financial decision-making.

Engineering for market speed and resilience

AI’s reliability is often tested under stress. Trading volumes surge during earnings announcements, macroeconomic updates, or geopolitical events, putting pressure on data systems and decision engines. For retail traders, quick access to accurate insights at such moments can be decisive.

TigerAI is engineered for these conditions. Its deep integration with Tiger Brokers’ trading and data infrastructure provides direct access to live financial feeds, research, and derivatives data. Du explained that this enables users to obtain insights almost instantly, even during volatile periods.

To uphold data integrity, TigerAI employs a verification and correction mechanism that reviews outputs before delivery. Dedicated agents ensure factual accuracy, forming a self-auditing feedback loop within the system. Each insight also includes a built-in “news traceability” function that links to original sources for verification. “Any content derived from news sources is clearly marked in the corresponding paragraphs, allowing users to view the original articles for verification and further reading,” Du said.

This focus on accuracy and transparency strengthens TigerAI’s reliability during volatile trading conditions. When markets move rapidly, investors depend on systems that can deliver verified insights without delay. Infrastructure performance and data integrity have become key measures of trust in AI-driven trading tools.

Personalisation under evolving compliance

AI’s value in finance lies in its ability to deliver personal relevance, yet personalisation brings complex privacy challenges. This regulatory scrutiny is reshaping how fintech firms design AI systems, pushing them to balance customisation with rigorous governance and transparency.

In Singapore, Tiger Brokers operates under a Capital Markets Services licence from MAS and aligns its data practices with the Personal Data Protection Act (PDPA) and the EU’s GDPR. Du emphasised that user trust is central to the platform’s approach: “Personalisation within TigerAI is based entirely on user-consented inputs, with user authorisation required prior to collecting any sensitive user data. All processing takes place within Tiger Brokers’ secure ecosystem, eliminating any external data sharing or third-party dependencies.”

TigerAI only processes information necessary for its features, such as portfolio data and stock watchlists. All trading data is anonymised, encrypted, and detached from identifiable information. Du noted that Tiger Brokers maintains complete transparency on data handling, supported by regular privacy policy updates.

These practices reflect a wider trend in fintech, which is the balancing of personalisation with accountability. As Asia’s data regulations mature and Europe’s AI Act sets new benchmarks, compliance will increasingly shape how AI-driven insights are delivered. Investors are becoming more aware of how their information is used, and platforms that earn their confidence through clear governance will build lasting loyalty.

Competition and the next wave of AI brokerage

The brokerage landscape is evolving rapidly. As execution speed and low fees become standard, the next frontier lies in intelligence. Brokerages are racing to offer insight-driven, AI-augmented experiences that provide tangible value beyond transactions.

Tiger Brokers has seen strong momentum, with global user growth up 262% year on year and AI interactions up 460%. These figures illustrate a clear shift in investor behaviour, toward platforms that translate complexity into clarity. Du believes this evolution is inevitable. “The next stage of competition among brokerages will hinge on how effectively firms can turn information into intelligence,” she said. “Investors are looking for platforms that help them cut through noise and make sense of what truly affects their investment.”

According to Du, AI’s real advantage lies in transforming vast information streams into tailored insights. “AI will redefine advantage by shifting focus from transaction efficiency to insight creation,” she explained. “Ultimately, the winning brokerages will be those that use AI to empower investors with clarity and confidence rather than just quicker execution.”

This shift marks only the beginning. As intelligence becomes the new currency of brokerage competition, the next stage of innovation will focus on how AI can deepen trust, tailor experiences, and guide investors across their financial journeys.

The next wave of intelligent investing

Looking ahead, Du believes the next wave of AI brokerage will be shaped by three forces: verifiable financial intelligence, advanced personalisation, and goal-driven wealth management. Together, they mark a turning point for how investors engage with technology, transforming trading platforms from transactional tools into intelligent financial partners.

Verifiable intelligence sits at the foundation of this shift. As AI takes on greater responsibility for financial analysis, credibility becomes as important as capability. The ability to trace data sources, validate responses, and assess the effectiveness of AI-generated strategies is now critical for trust. Tiger Brokers’ approach integrates verification mechanisms that test the accuracy of both data and conclusions, mirroring a broader industry movement towards transparent, evidence-based AI systems. The goal is to ensure that every insight delivered to investors is grounded in reliable information and measurable performance.

Personalisation builds on that foundation by recognising that no two investors are alike. AI systems capable of analysing behaviour, portfolio structure, and engagement patterns can generate insights that match each individual’s goals and risk profile. This shift from standardised advice to adaptive, context-aware guidance allows investors to act with greater precision and confidence. When applied responsibly, personalisation enhances accessibility without compromising privacy or regulatory compliance.

As these capabilities mature, AI is moving beyond asset allocation towards holistic wealth management. Instead of supporting short-term trading decisions, it is beginning to link financial actions with long-term objectives such as retirement, education, or property planning. This evolution positions AI as a constant financial companion, integrating day-to-day analysis with lifelong strategy. By aligning intelligence, trust, and purpose, platforms like TigerAI are reshaping retail investing into a more informed, personalised, and sustainable pursuit.