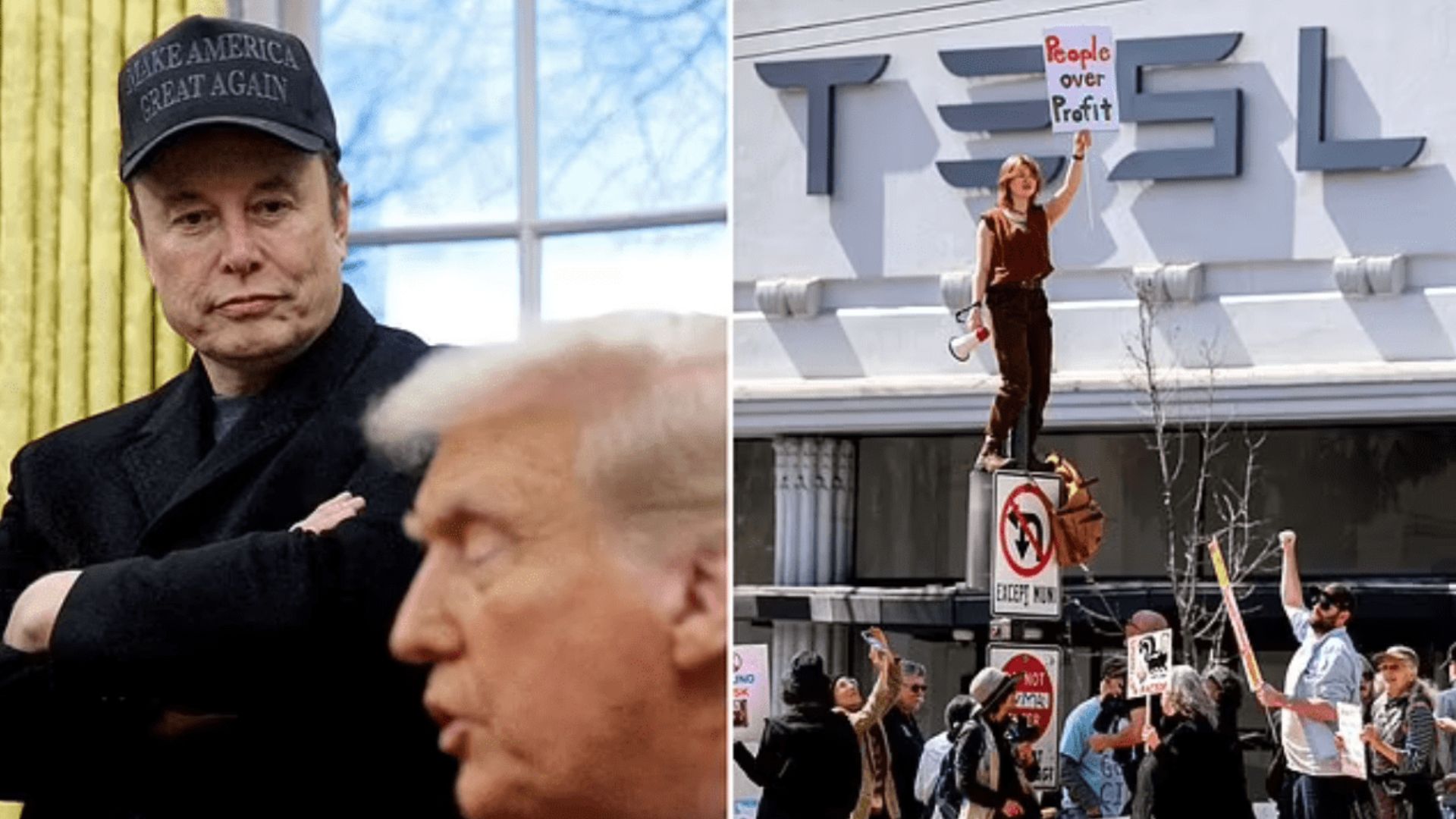

Tesla profits drop sharply as sales weaken and Musk backlash grows

Tesla’s profits fall 71% as sales dip, political backlash grows, and hopes turn to cheaper EVs and robotaxi plans.

You may have noticed Tesla is struggling to keep pace this year, and the latest financial update confirms it. On April 23, Tesla revealed its profits had dropped by a staggering 71% compared to last year. That’s one of the steepest recent declines the electric carmaker has faced.

In the first quarter of the year, Tesla earned US$409 million in net income from US$19.3 billion in revenue. While those figures might still look strong at first glance, they mask a deeper concern. The company delivered almost 337,000 electric vehicles during this period, marking its worst delivery quarter in over two years. It’s also the first time Tesla has reported a year-over-year drop in sales.

Many of Tesla’s profits came from selling US$595 million in zero-emissions tax credits. Without these, the company would have posted a loss. This raises concerns about how reliant Tesla’s earnings are on credits rather than car sales — the core of its business.

Despite the drop in profits, Tesla’s stock rose slightly after markets closed. Investors seemed encouraged by CEO Elon Musk’s statement that Tesla will begin building a more affordable electric vehicle in June. Musk also said he would step back from his duties with the Department of Government Efficiency (DOGE) to focus more on Tesla. However, he didn’t confirm a complete exit and may continue working with DOGE until Donald Trump’s second presidential term ends.

Trade tensions and politics impact Tesla’s future outlook

Tesla also warned investors that international trade tensions could affect its business. The company pointed to US tariffs, especially those targeting China, and shifting political attitudes as possible threats to demand for its vehicles. These issues could make it harder for Tesla to sell cars in key markets.

The company mentioned that the tariffs would hurt its energy division more than the automotive side. Still, Tesla said it is trying to stabilise its medium- and long-term business. Even so, it admitted it can’t guarantee it will grow its sales this year.

Tesla continues to plan to release more affordable vehicles. These new models are expected to enter production in the first half of 2025. During the earnings call, Musk confirmed production would begin in June. The new vehicles will be based partly on the next-generation platform used for Tesla’s upcoming robotaxi, but they will also use the current systems found in Model Y and Model 3. This means they can be built on existing manufacturing lines.

This announcement contradicts a Reuters report last week, which claimed production of these vehicles had been delayed by several months.

Ageing models, weak Cybertruck sales, and robotaxi concerns

Tesla’s current lineup of electric vehicles is starting to feel outdated. While the cars have received some design updates, they no longer offer the excitement they once did. The Cybertruck, once seen as a bold step forward, hasn’t delivered the impact Musk hoped for. Meanwhile, his outspoken political views and ties to Trump’s administration have caused a public backlash, damaging the company’s image.

Musk is also focusing heavily on new projects like the Robotaxi and Optimus robots. He promised that the first Robotaxi service would launch in Austin this June, with other cities to follow by year’s end. However, he hasn’t shared much about how the service will work or when it will be fully ready. Despite years of promises, Musk has yet to show that Tesla cars can safely drive without human help.

A recent report by The Information added to concerns, suggesting Tesla’s internal review found that the robotaxi project would likely lose money for a long time, even if it did manage to launch.

This time last year, Tesla also faced disappointing figures. Profits in the first quarter of 2024 dropped 55% to US$1.13 billion from the year before. Tesla blamed price cuts and unexpected challenges for the decline. By the second quarter, profits fell to US$1.5 billion — down 45% from the previous year. That result included a US$622 million restructuring charge but was boosted by a record US$890 million in regulatory credit sales.

All signs suggest that Tesla is under pressure from many sides. Whether it can turn things around with its upcoming affordable models and robotaxi plans remains to be seen.