Visa reports Asia Pacific’s shift to app-based remittances in 2025 study

Visa’s 2025 report shows Asia Pacific’s remittances shifting to apps, with security, speed and ease of use driving digital adoption.

Visa has released findings from its Money Travels: 2025 Digital Remittances Adoption Report, highlighting a clear shift across Asia Pacific towards app-based money transfers. The study surveyed 44,000 senders and receivers in 20 countries and territories and positions Asia Pacific as a key region within a global remittance market valued at about US$905 billion.

Table Of Content

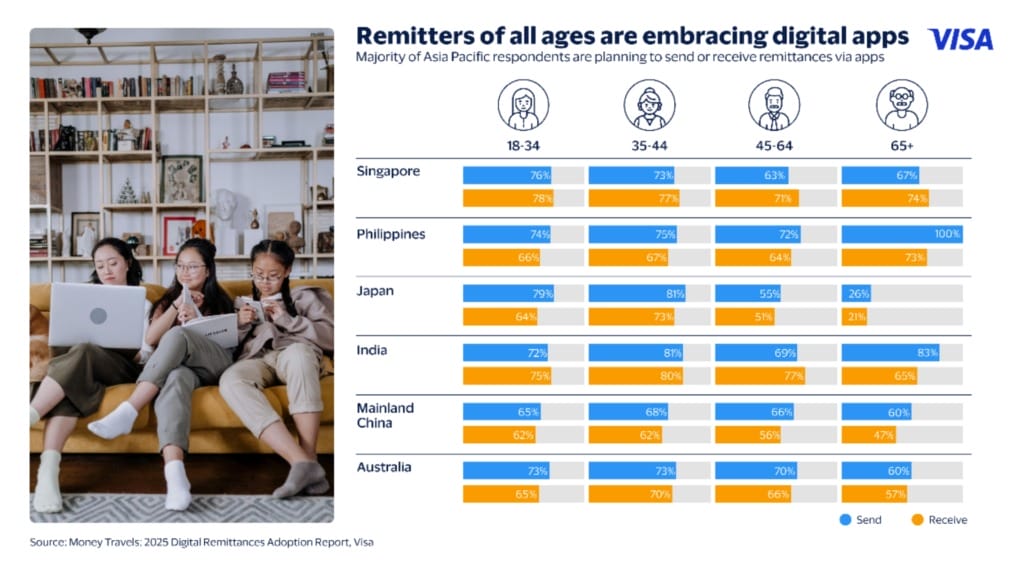

The report identifies digital applications as the most popular way to send and receive funds. Respondents cited ease of use, safety, privacy and security as the top user experience factors driving adoption. “Remittances have long driven growth across Asia Pacific, uplifting many economies in the region,” said Chavi Jafa, Senior Vice President, Head of Commercial and Money Movement Solutions, Asia Pacific, Visa. “The clear shift to app-based remittances reflects the region’s demographics, the growing prominence of digital payment modes, as well as user preferences for easy, safe and quick ways to send and receive money. This shift is an important one for banks, remitters and fintechs to note as it will shape how they engage and serve evolving consumer expectations.”

Digital adoption and speed in Asia Pacific

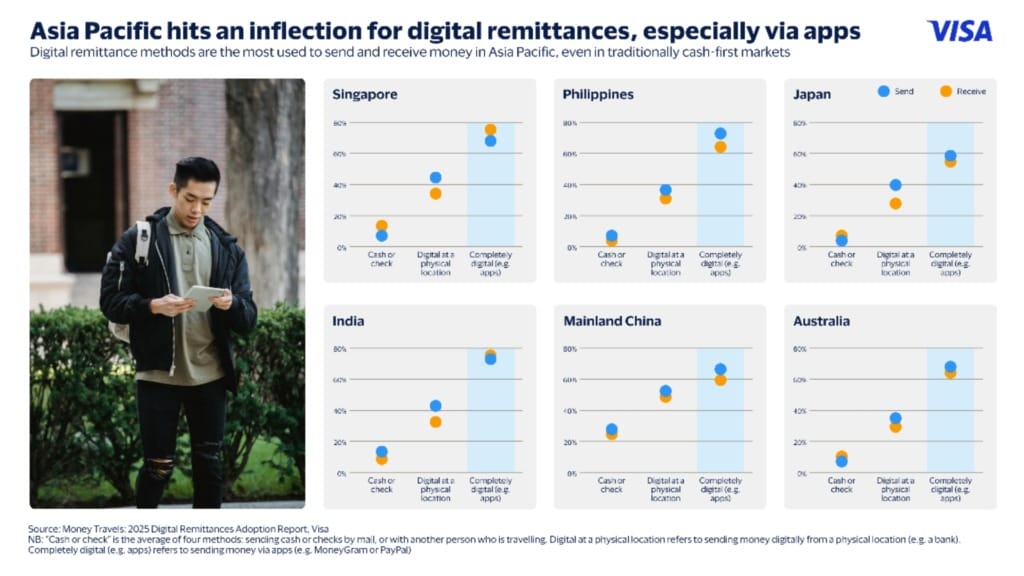

Digital apps remain the most preferred channel for cross-border transfers across the region. Usage is highest in India, where 74% of senders and 76% of receivers use digital apps, followed by the Philippines at 74% and 66%, and Singapore at 70% and 75%. Japan is also seeing steady growth, with digital app usage in 2025 reaching 58% for senders and 56% for receivers, up 10 percentage points on the previous year.

Speed is a core driver of this move to digital. Overall, 73% of respondents view digital payments as the fastest way to access funds. That sentiment is reflected in key markets, including the Philippines at 73% for both senders and receivers, Australia at 58% and 55%, Singapore at 67% and 66%, and India at 55% and 53%. Users also reported relatively smooth digital experiences, with a majority encountering no issues when sending or receiving. Positive responses were most notable in Australia at 48% and 53%, Japan at 37% and 41%, Singapore at 36% and 37%, and Mainland China at 38% and 31%. Mainland China also recorded strong year-on-year gains in issue-free experiences, up 13 and 8 percentage points respectively from 2024.

Reasons for sending and receiving

The motivations for cross-border transfers vary by market. Contributing to accounts or investments ranks as a primary reason across several economies, including Mainland China at 45% of senders and 36% of receivers, Singapore at 38% and 33%, and Japan at 27% and 23%. Humanitarian support is another major driver. Respondents in Mainland China cited general or specific need at 45% for senders and 33% for receivers, with India at 40% for senders, Singapore at 27%, and Australia at 25%.

Unexpected needs are also a common trigger, led by India at 44%, the Philippines at 41%, and Australia at 31% of senders. A regular cadence of receiving remittances was reported by about a third of respondents in several markets, including the Philippines at 39%, Mainland China at 34%, and India at 30%.

Security, fees and industry response

Security and convenience are shaping channel choices. Digital apps are viewed as the most secure way to send and receive money in Asia Pacific, with top responses from India at 50% and 53%, Australia at 49% and 45%, and Singapore at 44% and 42%. Ease of use was also frequently cited, led by Singapore at 51% for both senders and receivers, the Philippines at 48% and 54%, Japan at 47% and 42%, and Australia at 42% and 40%.

Fees remain a leading pain point. For digital apps, high costs were flagged by respondents in the Philippines at 43% and 30%, India at 36% and 33%, and Singapore at 32% and 32%. Physical remittances face similar concerns. High fees were the top challenge across the region, with the Philippines at 45% and 29%, India at 41% and 37%, Singapore at 38% and 30%, and Australia at 29% and 30%. Physical methods also introduce inconvenience and travel time, which respondents in India at 36% and Mainland China at 27% cited as barriers. In Australia and Singapore, 29% of respondents in each market described the in-person process as inconvenient and time-consuming, alongside high fees. Perceived security for physical remittances was generally low at between 3% and 6% in most markets, with slightly higher confidence in Mainland China at 10% to 12%.

Visa notes that around one billion people rely annually on remittance services and platforms. “Remittances have long been a lifeline across Asia Pacific, and they will continue to play a vital role in uplifting communities and livelihoods. At the same time, many small businesses are also beneficiary of remittances driving local growth in local economies,” said Rhidoi Krishnakumar, Vice President, Head of Visa Direct, Asia Pacific, Visa. “At Visa, we recognise the enduring purpose of our role in delivering remittances on behalf of our clients and continue to innovate and build solutions to enable more efficient, reliable and secure ways to move money.”

The company works with global remitters, including MOIN, WireBarley, Money Chain World Remittance and EzRemit, to support digitised money movement. As context, the World Bank estimates that officially recorded remittances to low- and middle-income countries were expected to reach about US$685 billion in 2024, larger than FDI and ODA combined. Further background on the role of remittances is available from IFAD.