Southeast Asia drives US$42B surge in social commerce adoption

Southeast Asia is leading a US$42B social commerce boom as TikTok, Meta, and YouTube turn content into seamless shopping.

Social media platforms in Southeast Asia have rapidly evolved into full-scale commerce ecosystems. By the end of 2022, social commerce contributed approximately US$42 billion to the region’s e-commerce market, representing about 25% of total online sales. Whether it’s a shoppable TikTok video, a Facebook Live sale, or a creator-tagged product on Instagram, users across the region are now discovering, evaluating, and purchasing—all without leaving their social apps.

Table Of Content

The transformation is rooted in a mobile-first culture, with high social media penetration and a strong creator economy. Southeast Asia’s digital landscape offers the ideal conditions for platforms to test and scale new retail experiences. For global platforms, this isn’t just a high-growth region but the blueprint for what the next era of commerce could look like worldwide.

Regional behaviours shaping platform strategies

Understanding local behaviours is key to explaining why social commerce has taken off in Southeast Asia. Across the region, consumers are highly active on mobile, spending upwards of five hours a day online, primarily on social media. This mobile-first usage means discovery often begins and ends within an app.

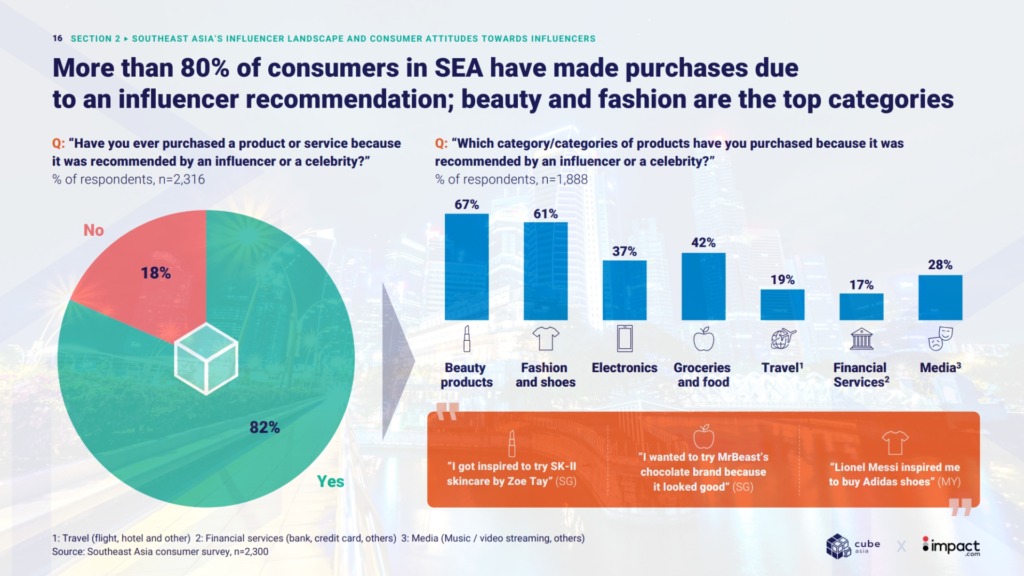

Trust in creators and influencers is another defining trait. Over 80% of SEA consumers report making purchases based on influencer recommendations, and platforms have adapted by creating affiliate programmes and tagging tools that empower these creators as sales agents. Influencer-driven commerce is central to user decision-making, whether fashion hauls on Instagram or product reviews on YouTube.

Southeast Asians also prefer interaction before a transaction. Conversational commerce, where users message a seller on WhatsApp or Instagram DM before purchasing, is deeply ingrained in buying habits. Platforms that integrate chat features with product catalogues are gaining traction for this reason. Users expect engagement, personalisation, and a sense of community, not just one-click checkouts.

Finally, the typical shopping journey in the region spans multiple platforms. A user may spot a product on YouTube, compare prices on Shopee, ask about it on Instagram, and make the final purchase through TikTok Shop. This fragmented journey pushes platforms to offer end-to-end experiences, blending content, chat, fulfilment, and payments to retain users within their ecosystem.

TikTok’s rise as a full-fledged commerce engine

TikTok has quickly become a dominant force in Southeast Asia’s e-commerce landscape. Since launching TikTok Shop, the platform has grown its regional GMV from US$4.4 billion in 2022 to more than US$16 billion in 2023, with Southeast Asia contributing over 80% of its global sales. Indonesia alone accounted for more than US$6.2 billion, followed closely by Thailand, Vietnam, and the Philippines.

The platform’s success lies in its seamless integration of entertainment and commerce. Users can watch a creator’s video, click on a tagged product, and complete a purchase, all without leaving the app. Live shopping, in particular, has seen widespread adoption. Over 40% of GMV for top sellers now comes from livestream sales, where creators demo products and engage directly with viewers in real-time.

TikTok’s affiliate model has empowered a new class of sellers and influencers. In late 2023, more than 20 regional creators surpassed US$1 million in monthly GMV, illustrating the scale of the opportunity. Campaigns like #TikTokMadeMeBuyIt fuel product virality and tap into the platform’s powerful discovery algorithm. For many SMEs and D2C brands, TikTok Shop is becoming their primary storefront.

With continued investments in logistics, payments, and local seller support, TikTok is leading and helping define the social commerce wave in Southeast Asia.

Meta enables commerce through discovery, chat, and community

Meta platforms, particularly Instagram and Facebook, continue to play a foundational role in social commerce, offering a more conversational and community-driven experience. Instagram is a key platform for discovery, especially in fashion, beauty, and lifestyle. Shoppable posts and Instagram Shops allow brands to tag products and guide users to purchase paths, even if checkout often happens via Facebook or external links.

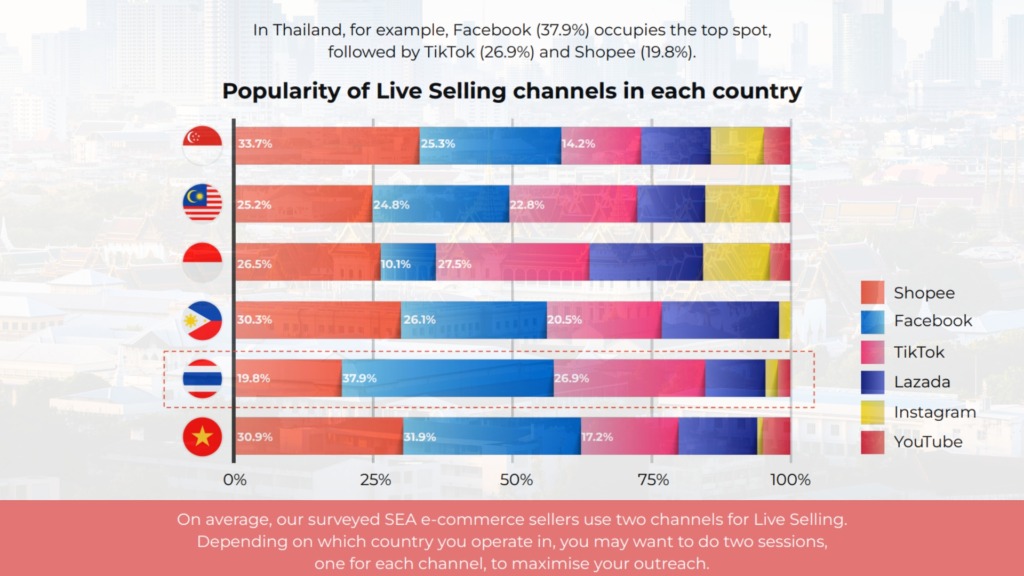

Meanwhile, Facebook dominates community commerce. Its Marketplace remains widely used for peer-to-peer sales in countries like the Philippines and Vietnam. Facebook Live, in particular, has become a critical sales tool—especially in Thailand, where nearly 38% of e-commerce sellers used it to reach audiences in 2022. Sellers host regular live streams, take orders via comments, and follow up over Messenger, turning live sessions into retail events.

Meta’s integration of Messenger and WhatsApp provides another edge. In markets like Indonesia and Malaysia, WhatsApp Business is essential for small businesses, enabling catalogue browsing and customer service through chat. For consumers who prefer to “talk before they buy,” these tools offer a more trusted, human buying experience.

Meta has also streamlined product management through unified catalogues for Facebook and Instagram, making it easier for SMEs to maintain their listings across both platforms. While its commerce model is less transaction-driven than TikTok’s, Meta excels in driving high-intent discovery and nurturing relationships that convert.

YouTube blends creator trust with shoppable video formats

YouTube, long known as a hub for product reviews and tutorials, is now building direct shopping capabilities to match changing user expectations. In 2024, it partnered with Shopee in Indonesia, Thailand, and Vietnam to enable creators to embed shoppable links within their videos. Viewers can now click on a product featured in a video and check out via Shopee, all within a YouTube interface.

The platform has also expanded its YouTube Shopping affiliate programme to six Southeast Asian markets. This program allows creators to tag products in their videos, Shorts, or live streams and earn commissions from sales. Beauty and tech influencers in the region have quickly adopted the feature, seeing increased engagement and monetisation.

What sets YouTube apart is the depth of trust it commands. In surveys, users in Indonesia and Thailand ranked YouTube creators as more credible than those on TikTok or Instagram, especially for considered purchases like electronics or skincare. This trust factor gives YouTube an edge in high-value verticals, even if it lacks the impulsive purchase behaviour seen on TikTok.

As the platform continues to expand shoppable video features and integrates with more e-commerce partners, it is positioning itself as a destination for video-led, trust-based commerce. YouTube may not yet match TikTok Shop’s GMV, but its long-form format and loyal creator base offer a distinct path to monetising social shopping.

Southeast Asia sets the standard for future-ready social commerce

Southeast Asia is already operating several steps ahead as social commerce matures globally. The region’s distinctive blend of mobile-first usage, influencer trust, and preference for conversational, interactive shopping has created an ideal environment for platforms to experiment with new retail formats. TikTok, Meta, and YouTube have all leaned into this opportunity—tailoring their features, monetisation models, and content strategies to local user behaviours. In return, they’ve seen explosive growth in engagement and transactions, turning Southeast Asia into both a growth engine and a learning lab.

For businesses, the implications are clear: winning in Southeast Asia’s digital economy means adopting a native approach to social commerce. That includes leveraging creator partnerships, engaging in live and short-form content, and meeting consumers where they are—inside chat windows, video feeds, and live streams.

As global platforms continue to blur the lines between entertainment and e-commerce, Southeast Asia’s playbook offers both regional relevance, and a glimpse into the future of retail itself.